This post may contain affiliate links. Please read our disclosure policy.

You know how much we love going on vacation… to Hilton Head Island. Home away from home. Saving money for a summer vacation is easier than you might think, if you are planning on, too. These 10 ways to save money for vacation will help you find ways to save money and make your summer vacation debt-free!

10 Ways to Save for Vacation

So, you know that my family takes a lot of trips to the beach. At one point, they were practically free for us, since my grandparents lived where we vacationed. Since their passing, we still love to go there (I think it’s the memories that I love), but now it is an expense that we save for. We could spend our money on things, but we’d rather spend it making memories for our kids. Our favorite vacation spots are Disney, Universal, and HHI.

Here are some ideas to find different ways to save to make your holiday as fun as possible and without going into debt!

- Get a second job (here is a list of work at home jobs), make sure all the money you earn for this job goes towards your holiday fund! If you have to pay for childcare or travel expenses, try to budget carefully as you want the job to pay for your holiday!

- Loose change, put this in a jar every night when you empty out your pockets. It is surprising how quickly this adds up! Have a special loose change jar that you just put this money in, it prevents you from picking which coins you will save and which coins you want to spend! My mom did this one year when I was younger, and by summer, she had enough to take our whole family on vacation.

- Make saving for your summer vacation a priority, include a category in your budget and put money away each month for your holiday!

- Try cutting back on eating out, even just cutting one meal a month and put what you would spend into your savings fund! If you read my post about saving money by eating at home, you’ll know that the average family spends a lot at restaurants every month.

- Cut out take out coffee on your way to work, put this money into your holiday fund each week! $2 a day can really add up!

- Cut back your grocery budget, even just a small amount will quickly add up. Put any change from your weekly shop into the vacation fund too! You could even try a no spend week and eat food from your freezer and store cupboard and then put your food budget for the week into your holiday fund! Here are some tips to save money at the grocery store.

- Give up something you love! If you stop buying chocolate or the extra bottle of wine on the way home from work. Not only will you feel better for it but you will save money for your summer vacation too. For me, it’s diet cokes from McDonalds. At $1 a day, it doesn’t seem like a lot, but that’s $30 a month. Mickey buys unsweet tea… so now we are up to $60 a month on drinks.

- Sell items around your home that you no longer want or need. Make sure you put the proceeds from these straight into your summer vacation fund! One year I made a LOT of money selling stuff on Craigslist & eBay.

- Create a family holiday savings jar, encourage all family members to contribute money into this jar with change from their pockets, etc… Regularly, empty the jar and pay the money into your summer vacation bank account, it will prevent family member’s being tempted to borrow from the jar! Mark the amounts saved on the jar so you all know how much is in the summer vacation fund!

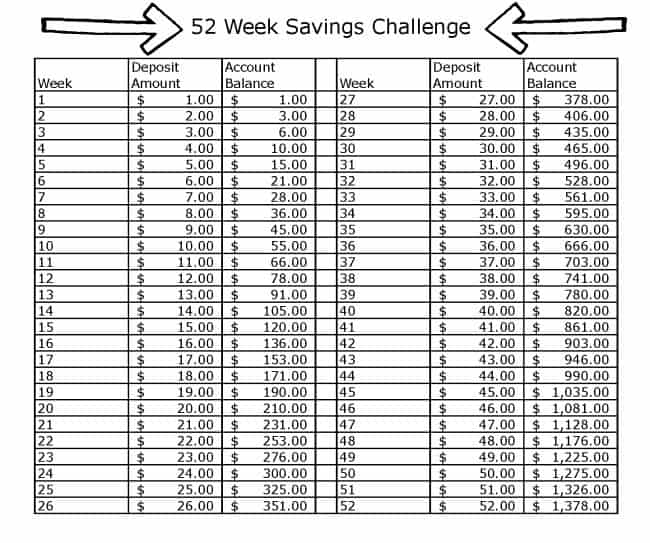

- Follow a savings challenge, this is a great idea as you can see your progress, try competing with a friend to see who can save the most!

A Debt-Free Summer Vacation

It is so much better to head off on vacation knowing that you haven’t put your vacation on your credit card. Mickey and I are debt-free and the thought of putting a vacation on a credit card is just not worth it to us, because of the stress that it would cause. For us, saving enough to pay cash is the only solution, but luckily these tips make it pretty easy to do so.

Paying for your summer vacation with challenges and cutting back makes your holiday experience even more special, as you won’t be heading home knowing that you have a massive debt to pay off!

After Your Summer Vacation

If you get into the habit of saving money and cutting back, you can continue after your summer vacation. By starting immediately after your vacation, you will save even more for next year’s summer trip!

Ps- sign up here to join my Your Modern Deals facebook page, where I share deals & giveaways.