This post may contain affiliate links. Please read our disclosure policy.

Kids learn from our examples, right? How about when they don’t. When do they learn to make dinners? Do laundry? When do they learn how to sew buttons or mend clothing? When do they learn how to spend their money and how to pay it back?

Sometimes, kids don’t learn from example – they learn from one on one instruction. They learn from their parents talking to them about saving their money and paying the money back, paying their mortgage and bills on time. They learn how to prepare dinner because they spend time in the kitchen with their parents preparing and cooking meals. They learn how to do laundry because we teach them.

Our oldest son is ten years old and I have started teaching him how to make simple meals, meals that he can cook and prepare (while I am home). He is learning how to follow a recipe and make it as it is shown. I do this because I want to raise a responsible adult… four responsible adults. Adults that learned simple lessons now, as children, so they can avoid big mistakes, as adults.

We have shown our kids how to do laundry- the whole process. We tell them why they can’t let it sit in the washer or the dryer, we talk to them about how often to wash their sheets and their clothes.

We are teaching our kids about simple home maintenance. When to change batteries in the fire extinguisher, how often to change the filters in the house, how often to clean out the refrigerator, etc…

We want them to understand how to watch their money- when it is OK to borrow money and when you need to pay it back. My parents showed me how to balance a checkbook and how to save my money when I was in middle school. When I opened my first checking account, they showed me how to spend my money and what to do with my checks. They showed me the importance of not spending money as soon as you get it and that when you borrow money, you only borrow what you can payback.

In life, there are times when you will need to borrow money. While I don’t advise borrowing it to do frivolous things, I do advice spending money when you need to or when it will pay-off.

Stage the home appropriately. This makes all of the difference when you are looking to sell your home.

The key to borrowing money is paying it back.

A lesson that we are already teaching our kids is that when you take out a loan, you need to have a plan for what you will use it for (like staging a house) and you need to have a plan for how you will pay it back (with the commission of the sale). Your children need to understand that you aren’t just borrowing it without any thoughts of paying it back… thinking that the money will always be there. You are borrowing with the intent of paying it back.

We want our kids to know that when you spend money, you need to do a little research ahead of time.

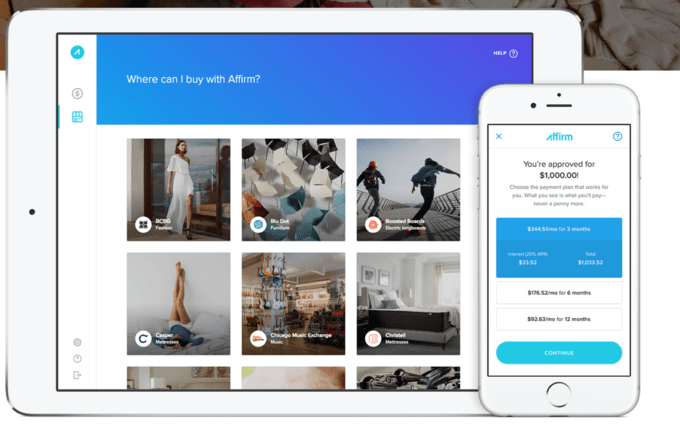

Are you buying the right place? Can you hold off and not spend it right now? If you get a loan, are you choosing the right company? We showed them how Affirm lets you buy today and pay over time in monthly payments and we explained how monthly payments worked. We showed them that sometimes this is what should be done for large purchases, like the staging of a house.

I can remember being in college and being swamped with credit card companies asking us to sign up and they would give us a free t-shirt. I watched as my friends all signed up. I knew that I wasn’t going to because of the fees. I plan to teach my children to look for companies that have hidden fees.

You need to know this because it is those hidden fees that get you if you aren’t prepared. You pay simple vs. compounding interest, so you only pay interest on your purchase and not on your interest. Then I will teach them how to avoid paying interest by paying on time. I will teach them to make informed decisions when making a large purchase by using companies that are transparent and simple.

Yes, sometimes our kids learn by example: kindness, generosity, study habits, but sometimes they need us to teach them. It’s best when we do them together.