This post may contain affiliate links. Please read our disclosure policy.

What do you think of when you hear “Saving for a RAINY day?” I asked my husband this and he said “saving for a worst-case scenario”. When I thought of this, I thought of saving money to do something fun when it is literally raining outside. haha! Go to a fun indoor park or buy a fun new toy (like a new video game system) that the kids will love.

What do you think of when I say “Saving for a SUNNY day?” I think about going away or spending money on something that you’ve been wanting! Maybe its a new house or a new car or a new phone.

Saving money can be challenging, especially when the goal may seem so far away or out of reach. It actually becomes a little easier when you envision the goal as the moment you are living for rather than the amount of money you need to save.

Here are 10 steps to take to live for your SUNNY day.

1. Pay more often to PAY DOWN YOUR MORTGAGE.

We pay for our mortgage every other week. This takes about 8 years off of our 30 year mortgage because you are essentially making one extra payment a year. Anyone can do this and it will take years off of your mortgage!

2. Talk to others & get advice

3. Don’t buy what you don’t need.

Try this for two weeks and see how much you save! Every time that you want to spend money, just take that money and put it into a jar. Example: If you were going to buy a Coke from a restaurant, when you get home, put that $2.00 into a jar. Add it up at the end of two weeks.

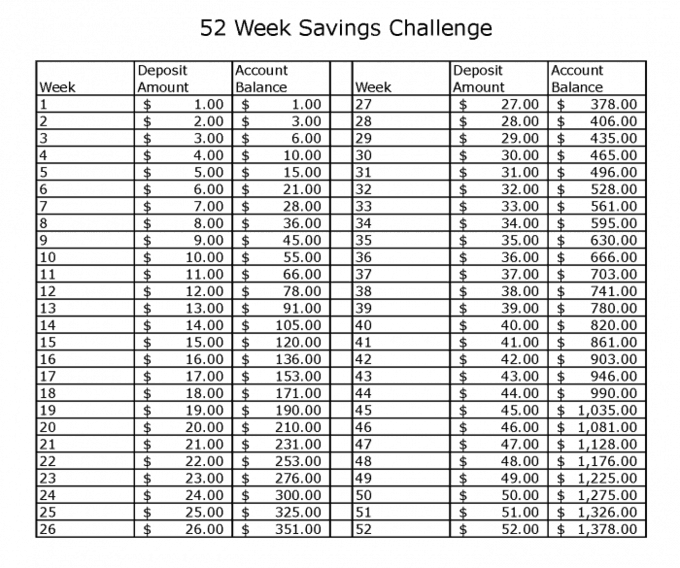

4. Put away a dollar a week. Every week, add a dollar to that jar until the 52nd week of the year when you are putting away 52 dollars that week. You can print out a picture like the one below and tape it to a jar.

5. Do vacation swaps.

My friend swaps houses with others for vacations. She saves thousands this way! You can find them just by googling Vacation Swap. She is essentially going on her vacation for free (they only pay for travel and food, but they bring their food and they drive, so they save a lot of money! You can see my vacation-saving tips here)

6. Grocery shop on the “Day Old” shelves.

Most stores have “day old” breads & produce. This will save you a lot of money. You can also buy your meat this way… I often buy meat $2-$10 off because it has reached its sell-by date.

7. Have money taken right out of your check and moved to a seperate account, before you even get a chance to look at it. You can’t spend it if you don’t have it, right?

8. Set a budget.

You can find free budgeting apps online or you can write it out with a pencil and notebook. Either way- try to stick to it! Give yourself a budget for groceries, bills, entertainment, etc..

9. Cook from scratch.

This one is hard with the convience of eating out, but it will save you a lot of money (and it is usually healthier, too!) I try to make meals that don’t cost a lot – these 15 meals for $5 or less might help.

10. Don’t use credit cards when you don’t need them.

If you are using them to pay for medical bills, thats understandable. If you are using them to buy the latest and greatest TV, just stop and wait until you have enough money saved to buy it with cash.