This post may contain affiliate links. Please read our disclosure policy.

When Mickey and I were just starting out, after being married, we decided that we needed a finance plan. We had just bought our first house and our cars. It was time to get serious about saving. Today, as part of a sponsored post and as part of the Mom It Forward Influencer Network, I wanted to share a few ideas with you.

Our goal has always been to have zero debt, even if it means that we go without certain things to get there. Having zero debt means having little financial stress, and that was important to me.

Goals:

1- Pay off cars

2- Build up savings

3- Pay off mortgage early

4- Put away money for annual vacations

5- Find our perfect bank (to help reach these goals)

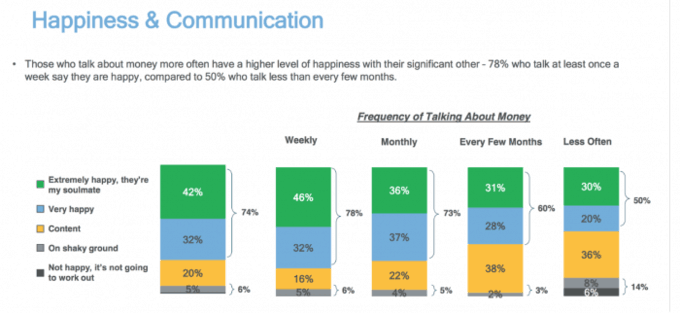

We needed to figure out a plan, so we talked about it. We also knew that we needed advice. I highly suggest talking to your bank or to a finance company to map out a finance plan. TD Bank is the human bank, so they offer Customers personalized service to help find the perfect match of financial products and solutions. It is important to talk about these things together as a couple and to go into the bank together. An honest discussion about finances could lead to a better relationship; TD’s Love and Money survey found that couples who talk about money regularly are happier.

I think that what it boils down to is making a plan with your spouse. Mickey and I have a shared plan and we have shared goals. We know that we want to be financially set so we can go on vacations, send our kids to college, not have to worry about our mortgage. Together, we know that these things will make our lives less stressed and therefore more fulfilled.

We aren’t afraid to talk about money. I don’t hide my purchases from him, because I know that if I can’t afford it, I won’t buy it. I look for sales and shop the clearance rack. Just yesterday I bought a pair of pants that were $150 for $19. They are so pretty, very well-made and remind me of the beach. I only buy things on sale because I’m focused on the bigger picture, saving for the future. While it may be challenging for many families, we’ve learned that consumers who establish a good savings foundation today can increase their likelihood of future financial health. So, take that money that you saved on your purchases and deposit it into an account to fund your long-term savings plan.

I thought that TD’s 2016 Love and Money Survey was helpful to bring this point home. You need to be doing these things as a family: saving as a family, talking about money with your family, etc… TD Bank can even provide expert advice about the advantages of a savings account (along with other products and services to help you reach your financial goals). This study and chart (below) just goes to show that when you communicate often and you are on the same page, it can make you happier. Take a look:

I think that it is because you are talking about important things… things that matter. You can see yourself meeting financial goals together.

One way to do this is to set up a money date, where you talk about your finances and check in to see how close you are to meeting your goals. You could even plan to meet with a professional every quarter or so to see how well you are doing on your path. You could make a plan to set up a joint savings, joint checking and other accounts. TD Bank is currently offering a checking product promotion with cash back offers during the TD Perfect Checking Match campaign.

They are even inviting new to bank customers to come in and meet with a banker to learn more about the right fit of products and services. By doing so they can qualify for offers and receive a complimentary month of credit monitoring. Existing customers who sit down with a banker for a relationship review will also receive the complimentary month of credit monitoring and be entered to win a $100 TD Bank Gift Card. Either way, you are learning about new financial tools that can help you meet your goals.

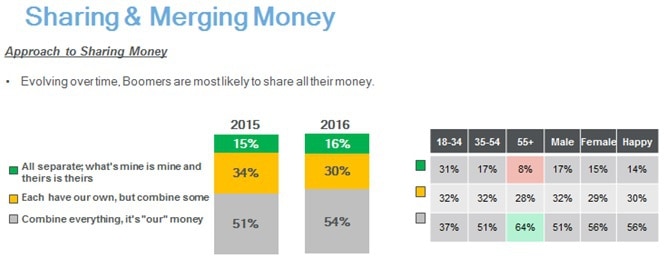

One last thing that I wanted to share with you, before you visit a local TD Bank for your money date, is the chart below – use it to decide what approach is best for you and your significant other. (Mickey and I are in the 51%).

You can find more infomation here.

An interesting correlation, but is this really cause and effect?